Market Summary (Sep 19, 2025)

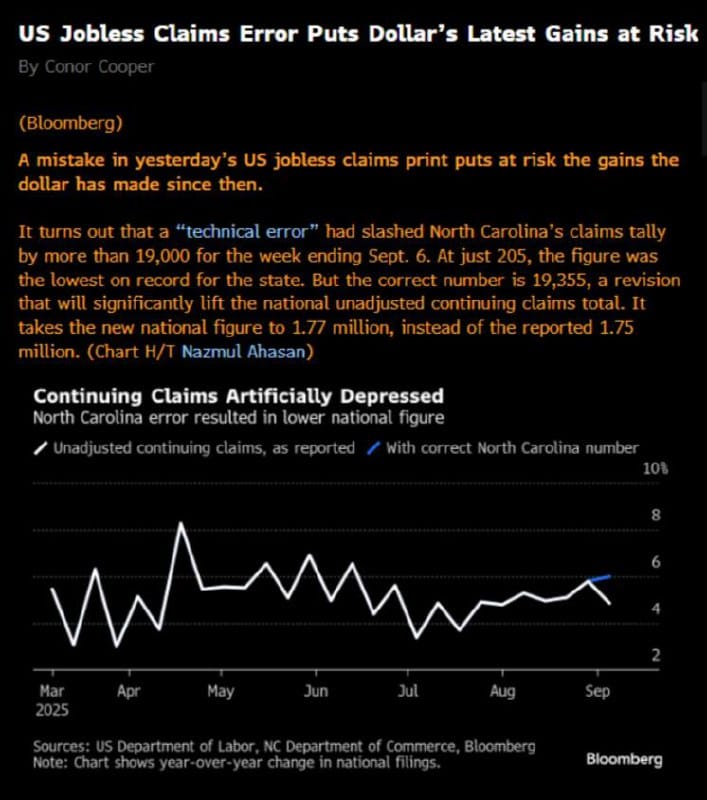

We’ve seen a classic “sell the fact” pullback in dollar pairs and gold after the Fed’s dovish guidance, but the real story today is the Bank of Japan’s hawkish surprise—two dissenters voting for a rate hike—which pushes USD/JPY towards 142.00 as Fed cuts and a likely BoJ lift create a steeper rate divergence. Meanwhile, a technical error in North Carolina’s jobless claims has just been corrected, lifting national continuing claims and removing a key underpinning of recent dollar strength. With the Fed on hold, BoJ on the brink of tightening, and a softer U.S. labor backdrop, we retain a medium-to-long-term bias for lower USD and higher gold (towards 3,800) and EUR/USD breaking above 1.2000 once technical triggers align.