Market Summary (Sep 11, 2025)

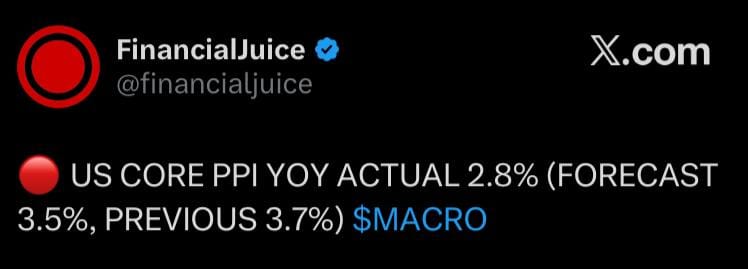

We’ve seen yesterday’s PPI core at 2.8% YoY (vs. 3.5% expected) and headline at 2.6% YoY (vs. 3.3%), which pointed to a soft CPI—yet today’s headline and core CPI matched forecasts at 3.1% YoY and 0.3% MoM, while initial jobless claims came in above consensus. This mix reinforces stagflationary pressures—external supply shocks and weakening labor demand—keeping the Fed on a path toward rate cuts. The US dollar remains under pressure: EUR USD retains its bullish higher-timeframe structure above 1.1550, and USD JPY is poised for a break below 147 once consolidation ends. Gold continues to look constructive, supported by the inflation outlook, looming rate cuts and heightened geopolitical risk, targeting a move toward 3,700. Equities may catch a relief rally but face significant downside risks amid the broader stagflation narrative.