Market Summary (Sep 10, 2025)

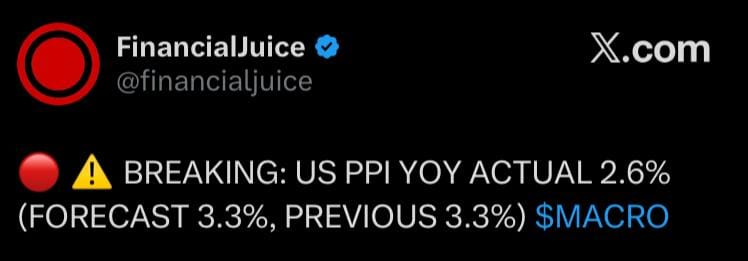

We’ve seen a sharp downside surprise in US PPI, with headline printing 2.6% YoY vs. 3.3% expected and core at 2.8% vs. 3.5%. Given the historical 80–90% correlation between PPI and CPI surprises, we’re positioned for tomorrow’s CPI to undershoot, sharply increasing rate-cut odds. The USD has reacted immediately: USD/JPY is set to resume its decline as JPY safe-haven demand returns, while EUR/USD has already broken a multi-month resistance trendline and looks ready to push higher. Gold has also been bid up on rising Fed-easing expectations, although equities face a mixed outlook—potential upside from lower rates but headwinds from ongoing tariff risks and geopolitical uncertainty. The hefty –911k downward revision to US payrolls further confirms a cooling labor market, reinforcing the disinflationary theme across fixed income and FX markets.