Market Summary (May 27, 2025)

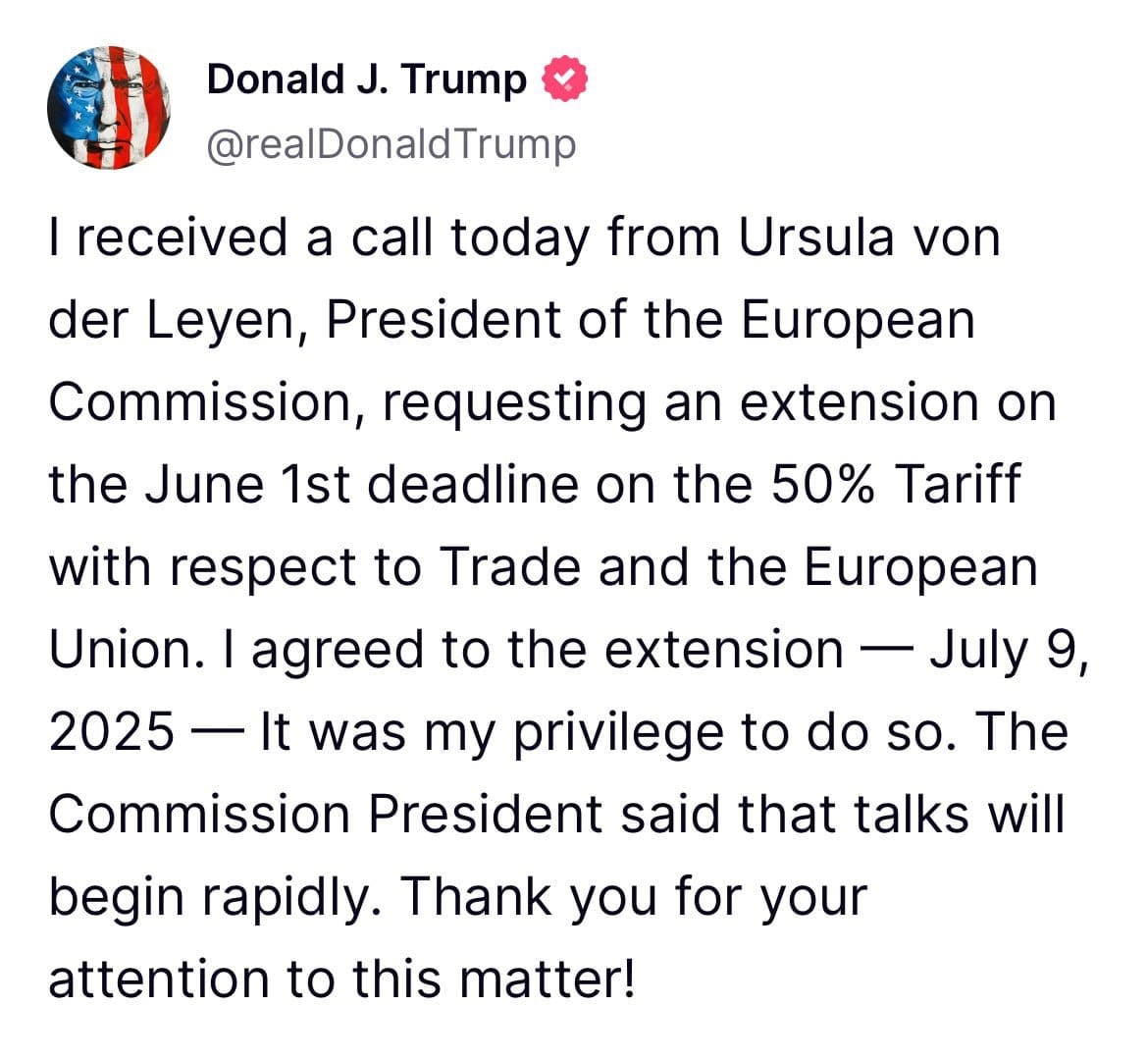

Markets have tilted back into risk-on after the U.S. delayed a planned 50% tariff on Europe from June 1 to July 9, giving equities and high-beta currencies like AUDUSD a lift while gold takes a breather. The dollar, paradoxically stronger today, is benefiting from the tariff “de-escalation” narrative and the lagged effects of yesterday’s U.S. bank holiday. Japan’s MoJ jawboning on bond yields and possible tweaks to long dated issuance are weighing on JPY. Gold remains in a corrective phase, with short-term pullbacks likely until there’s a fresh catalyst—either a break above resistance or renewed tariff/geopolitical tensions, particularly against the backdrop of intensifying Russia–Ukraine conflict and looming U.S. sanctions. Seasonal factors also support further equity gains into the NY session.