Market Summary (Jun 27, 2025)

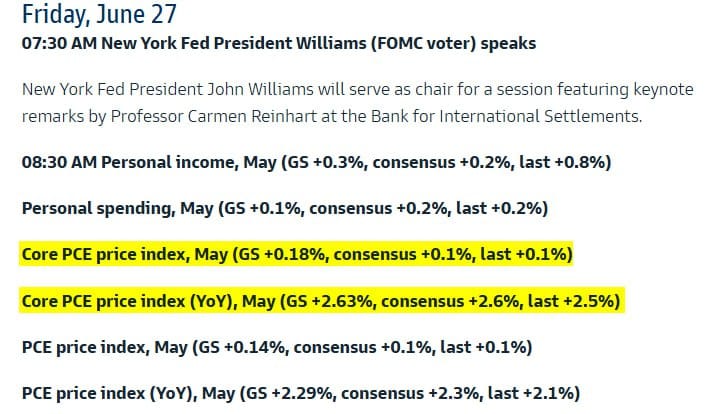

We’re focused on the May Core PCE release at 8:30 AM (consensus +0.1% MoM, Goldman +0.18%). Core PCE is largely baked in from recent CPI/PPI prints, so we’d need a surprise >0.2% to tilt markets risk-off—boosting the USD and pressuring equities and gold—while a tame print should keep the seasonal equity strength intact (Jun 28–Jul 22) and allow EURUSD to hold on dips. May personal income (+0.3%) and spending (+0.1%) were soft, and Fed remarks at 7:30 AM are unlikely to derail this view. Tariff negotiations around Jul 9 remain the next event risk.