Market Summary (Jun 26, 2025)

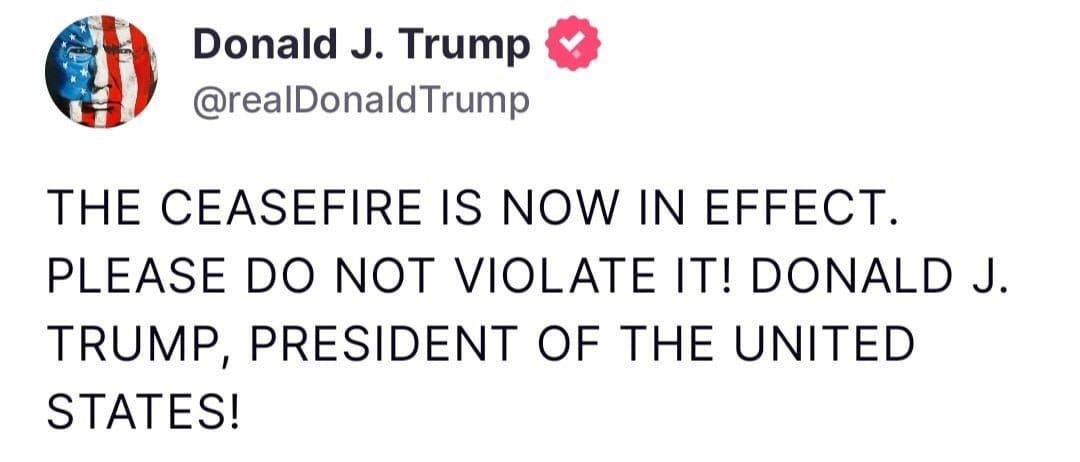

We’re seeing Middle East de-escalation cool off safe-haven bids, putting short-term pressure on gold toward the 3 250–3 280 area even as the broader macro drivers (fiscal risks, tariffs, de-dollarization, central bank buying) remain bullish into year-end. The U.S. dollar looks set for another leg lower ahead of tomorrow’s Core PCE release, helping EUR/USD clear its highs and eye 1.1800, while the S&P 500 enters a historically strong seasonal window (Jun 28–Jul 22). Core PCE surprises would need to exceed 0.2 pct to meaningfully shift this outlook.