Market Summary (Jun 18, 2025)

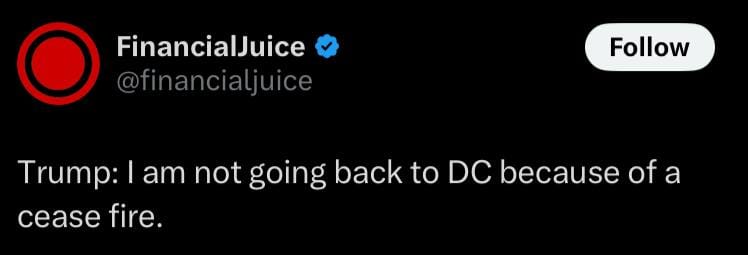

Despite equity benchmarks hugging record highs on hopes of a dovish Fed pivot tonight, markets remain on edge after President Trump abruptly left the G7, urging Tehran to evacuate and hinting that his return to Washington is “much bigger” than a mere ceasefire (see below). For now, the collective view is tilted toward de-escalation—which has kept gold soft around $1,925/toz and the dollar contained—yet any concrete breakthrough (e.g. regime-change confirmation) would see gold slump 50–80 points and the USD rally anew. Looking ahead, Chair Powell’s expected pre-cut dovishness should cap U.S. yields and weigh on the greenback, but an oil-price spike above $80/bbl on renewed Middle East tensions could undo that narrative, driving safe-haven flows back into gold, Treasuries and the dollar.