Market Summary (Jun 12, 2025)

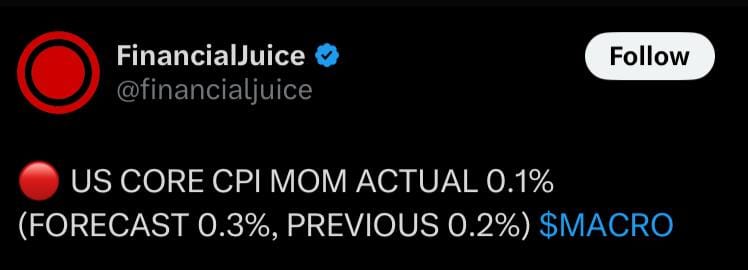

Risk sentiment has been buoyed by a dovish US CPI print (Core MoM 0.1% vs 0.3% forecast) and soft PPI, underscoring fading tariff-inflation fears and setting the stage for renewed Fed rate-cut speculation—boosting equities, crypto and high-beta FX (AUD, NZD, CAD) while keeping the USD under pressure. However, escalating Middle East tensions—US embassy evacuations and the prospect of an Israeli strike on Iran—have introduced a potent risk-off “tail,” which would propel traditional havens (GOLD, JPY, CHF, USD) and oil sharply higher if conflict breaks out. In the absence of a clear catalyst either way, markets are likely to grind sideways within these conflicting forces until one theme decisively prevails.