Market Summary (Jul 9, 2025)

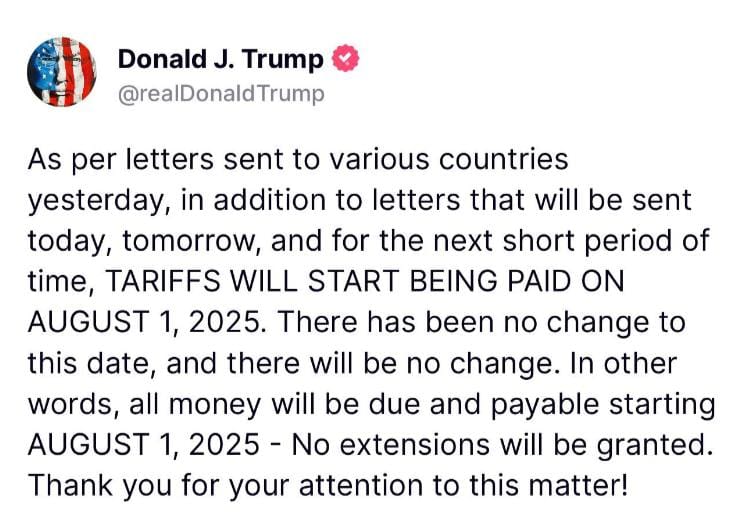

We are tracking renewed US tariff threats (50% on copper and 25–40% across Asia) due August 1, which is driving risk-off flows into safe-havens. Gold, trading around 3300, remains our favoured ballast, with any dip toward 3165 seen as a shallow retracement rather than a trend change. Copper is under near-term pressure but still features in longer-term portfolios. The USD’s safe-haven bid is countered by potential downside in USD/JPY if tariff tension persists, while equities and commodity-linked FX (AUD/JPY resistance ~95.7 daily 200 SMA, EUR/GBP underpinned toward 0.90) face headwinds from rising uncertainty.