Market Summary (Jul 3, 2025)

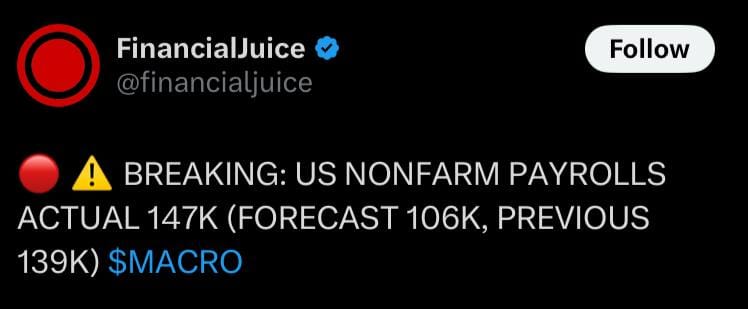

We entered the day bracing for a tariff scare ahead of the July 9 deadline—and got exactly that with a 20% levy on Vietnam and talk of extending threats elsewhere—keeping USD under pressure and gold bid. A sharp ADP miss stoked expectations for sub-100k nonfarm payrolls, but today’s 147k print (vs. 106k forecast) and a drop in the jobless rate to 4.1% underscore ongoing labor‐market resilience. That surprise has pushed rate-cut odds lower, spurred a USD bounce and a pullback in gold from the morning highs. Political noise around a Fed investigation is lurking, but for now markets are driven by stronger data and tariff geopolitics.