Market Summary (Jul 17, 2025)

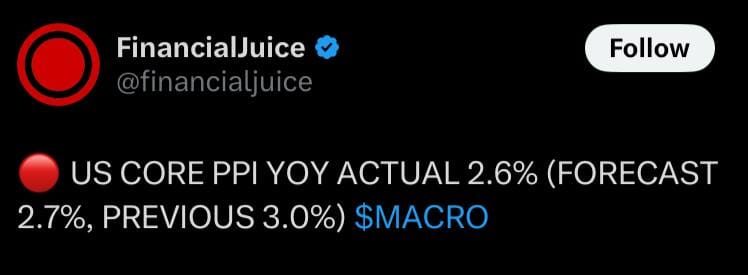

We saw another dovish PPI print yesterday (core PPI YoY 2.6% vs. 2.7% expected), reinforcing the view that underlying inflation is cooling and limiting the risk of another Fed hike. At the same time, persistent rumors that the Fed Chair could be dismissed remain a key tail risk. Markets are pricing in a weaker dollar—EURUSD is targeting 1.1750–1.2000—and are rotating into traditional safe havens, with gold trading back above 3,400 and set to challenge 3,700 in the medium term. Bitcoin is acting as a “digital gold” play on monetary debasement, while U.S. equities are under pressure on policy uncertainty. We’re monitoring today’s retail sales for signs of further consumer weakness.