Market Summary (Jul 16, 2025)

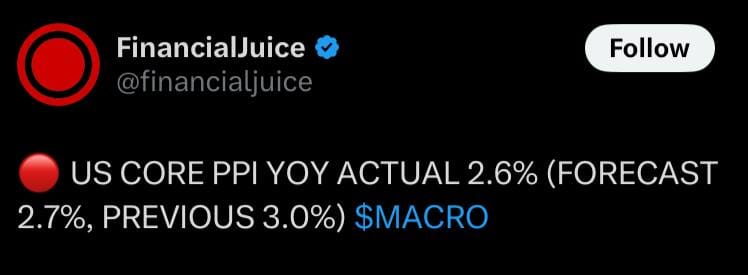

We saw US inflation hold broadly in line with expectations—core CPI rose 0.2 MoM (vs. 0.3 forecast) and 2.9 YoY—while core PPI disappointed at 0.0 MoM and 2.6 YoY, pointing to continued disinflationary pressure ahead of the PCE report. The dollar has rallied modestly but remains stuck in a choppy range, making it unwise to chase or fade aggressively. Gold is consolidating between 3 320 and 3 360 amid structurally robust central bank demand and a looming tail-risk around Fed leadership, keeping our medium-term bullish case intact. On FX, EUR USD sits in a well-defined bear channel from 1.1800; a break above that level on softer data could trigger a relief rally toward 1.19. Seasonal patterns also favor a stronger yen versus most crosses over the next month.