Market Summary (Jul 15, 2025)

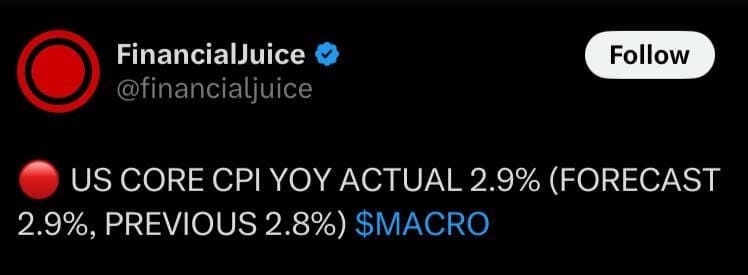

We see markets grapple with renewed U.S.–Russia sanctions rhetoric—threats of 100% tariffs in 50 days—and a Fed outlook supported by an inline July CPI report (Core CPI MoM +0.2% vs +0.3% exp; YoY +2.9% vs +2.9% exp). This geopolitical risk backdrop underpins gold’s safe-haven role, with the metal consolidating between $3,320–3,360/oz ahead of any fresh catalyst to push it toward $3,400+. The dollar’s strength remains intact, and EUR/USD would need a breach of 1.1720 to negate the ongoing down-trend channel. Overall, we remain patient, neither chasing the dollar rally nor fading it, while watching for sanction developments and central bank flows to steer gold and FX trends.