Market Summary (Aug 22, 2025)

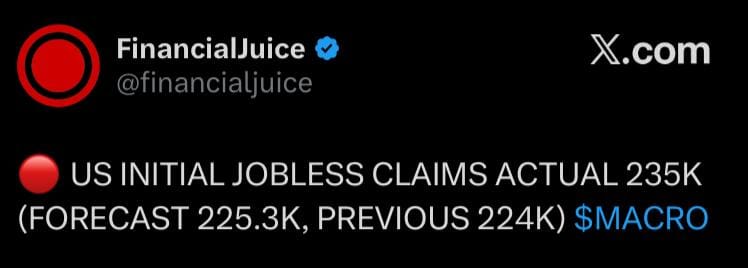

We see gold’s daily chart forming a bullish engulfing and breaking a corrective wedge, and Powell’s surprisingly dovish Jackson Hole remarks—highlighting labour-market risks and opening the door to a September cut—have driven the dollar lower and gold sharply higher. Momentum now targets the 3,500 area, though any meaningful peace-talks breakthrough could spark a ~3% pullback. US initial claims unexpectedly rose to 235k (vs. 225k forecast), and the flash S&P manufacturing PMI beat at 53.3, underscoring a mixed backdrop that keeps equities buoyant even as Treasury yields hover just under 4.90%. The USDJPY looks set to extend its retreat amid easing Fed rhetoric, while gold leads the commodity complex on renewed safe-haven and rate-cut bets.