Market Summary (April 24, 2025)

Risk appetite fluctuates amid US-China trade negotiations, with market sentiment swaying between optimism and caution. Gold under pressure, USDCHF shows technical bullish signals.

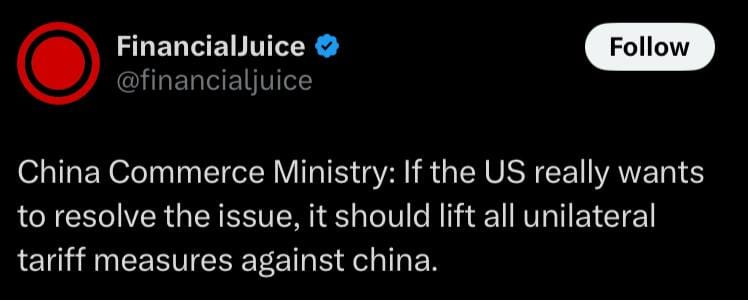

Risk appetite has been oscillating amidst mixed signals on US-China trade negotiations, with optimism driven by tentative US tariff easing hopes and tariff threats offset by China’s dismissive stance, as highlighted by official Chinese sources. Markets showed a risk-on flush following positive comments from Trump regarding tariffs and the potential for a US-China deal, supporting risk assets like equities and currencies such as USDCHF, which is approaching key breakout levels. Despite short-term volatility, technical setups favor a move higher in USDCHF, aligning with improved sentiment on tariffs and a bullish weekly engulfing pattern. Gold remains under slight pressure, with short-term downside targets around 3100. However, market participants remain wary of false signals, as geopolitical tensions and trade negotiations continue to influence volatility.