Market Summary (April 17, 2025)

The markets are currently under the influence of cautious macroeconomic signals and geopolitical uncertainty. The ECB’s dovish stance, with expected rate cuts and cautious forward guidance, is fueling short-term euro weakness, especially against the GBP. The US Federal Reserve remains hawkish, with no imminent interest rate cuts, but speculation persists about potential political interference in the Federal Reserve’s leadership—though such scenarios are deemed highly unlikely. Equity markets appear vulnerable, potentially retesting yearly lows around the 4900 zone on the S&P 500, which could trigger a strong correction in gold as safe-haven flows fluctuate. Overall, the environment is characterized by heightened geopolitical tensions, trade uncertainties, and central bank policy divergence, creating a cautious but potentially volatile macro landscape.

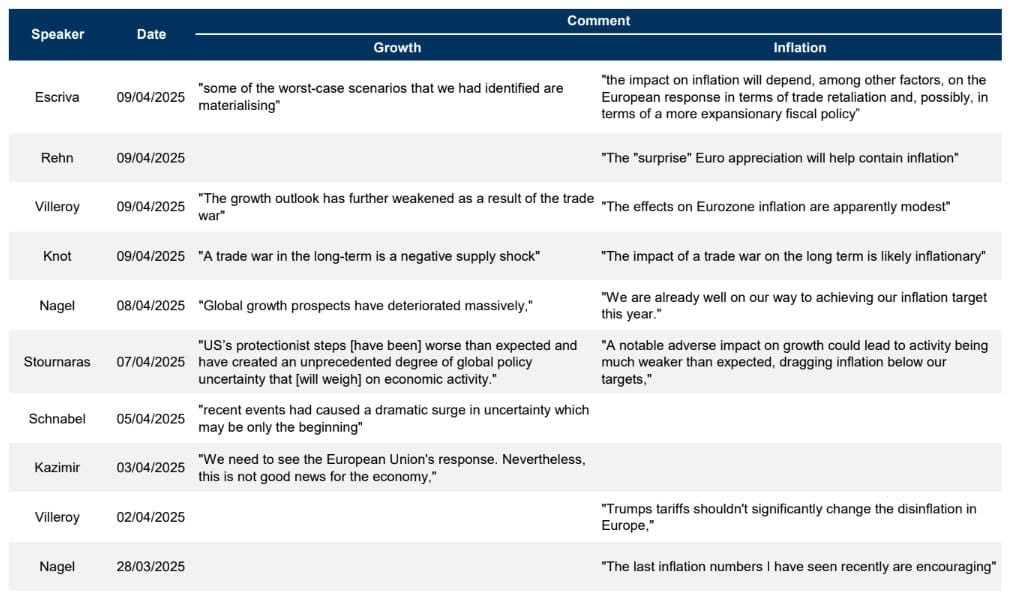

Media context indicates increasing downside risks to global growth and inflation, amplified by trade tensions and political dynamics in the US and Europe.