Market Analysis - 2025-09-12

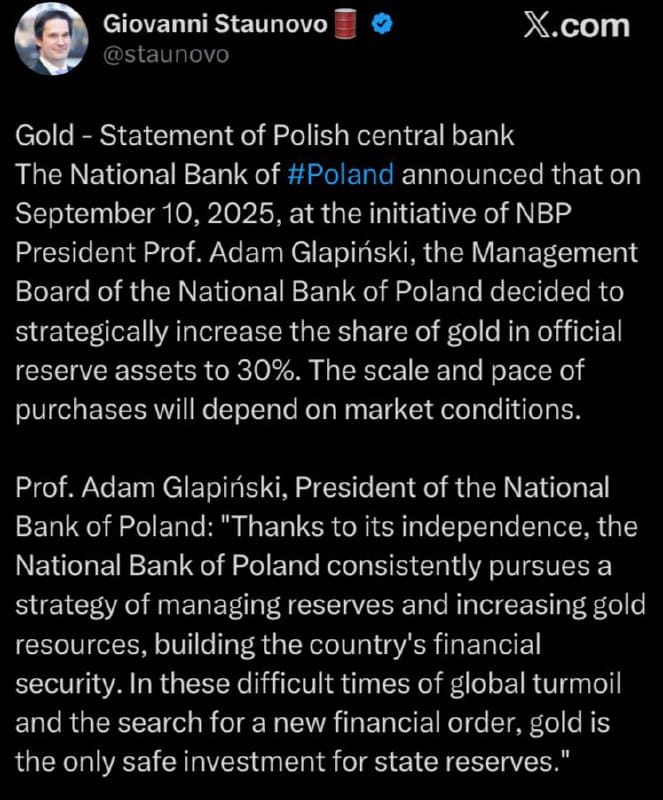

We’re seeing a clear stagflation backdrop: PPI and core CPI prints are in-line but labor-market data disappointed, while University of Michigan sentiment undershot and 5-year inflation expectations jumped. This mix virtually guarantees Fed rate cuts next week despite core inflation sitting above 3%, keeping downward pressure on the US dollar and supporting gold. EURUSD remains constructive in its bull-flag pattern toward the 1.18 area, USDJPY looks poised to give up its 147 support, and CHF is capped by a dovish SNB. Geopolitical strains and ongoing central bank gold buying—Poland has just boosted its gold reserves target to 30% of total assets—add further tailwinds to bullion.